Transaction management

The Transactions section allows you to view information about all your transactions and their details, filter relevant records, initiate secondary operations, and export data in table format.

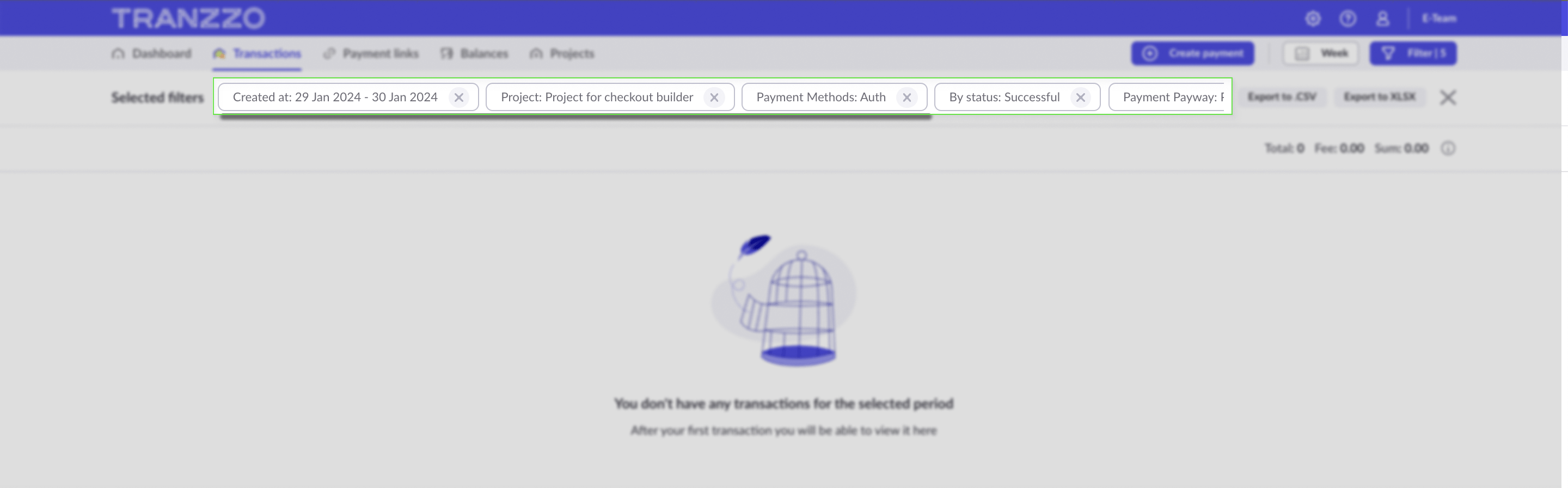

Transaction filtering

The filtering section allows you to set parameters to display your transactions on the page. You can filter according to the following parameters:

- Date: by the date of creation or execution of the transaction.

- Projects: according to the projects within which payments were made. For a large number of projects, you can use a partial match search in the project list.

- Transaction methods: Purchase, Pre-authorization (auth), Capture, Voiding pre-authorization (void), Refund, P2P, Card verification (lookup), Payouts (credit), Disputes, and Manual Transfers (Withdrawal, Account Replenishment, Rolling Reserve Replenishment).

- The “Show final transactions (2-step payments)” filter allows hiding records of Pre-authorization (auth) if a Capture or Voiding pre-authorization (void) has already been performed for the order when using two-stage payments.

- Payment statuses: by the status of the payments.

- Payment methods (by payment instruments). Start typing the name of the payment method and select it from the drop-down list.

- Card brand (Visa, Mastercard).

- Payment amounts and currency: by the range of payment amounts and their currency.

- Transaction ID: by the unique number for each transaction.

- Payment attributes: by specific attributes of the payment.

- Order ID and description.

- Payer information: by information about the payer (e-mail, phone, card mask) or the recipient of the P2P (recipient card mask).

- Sub-transaction ID and/or sub-merchant (only for split payments).

The filtering parameters can be used individually or in any combination.

The selected filter options are displayed at the top of the page. You can remove any of them individually or all of them at once.

Transaction list and additional features

The Transactions section displays a list of transactions with structured information about each of them.

Available features:

Export filtered transactions in CSV or XLSX format.

Transaction counter: displays the number of transactions, their amounts, and commissions.

infoTo enable the transaction counter, you must select a filter based on a specific currency.

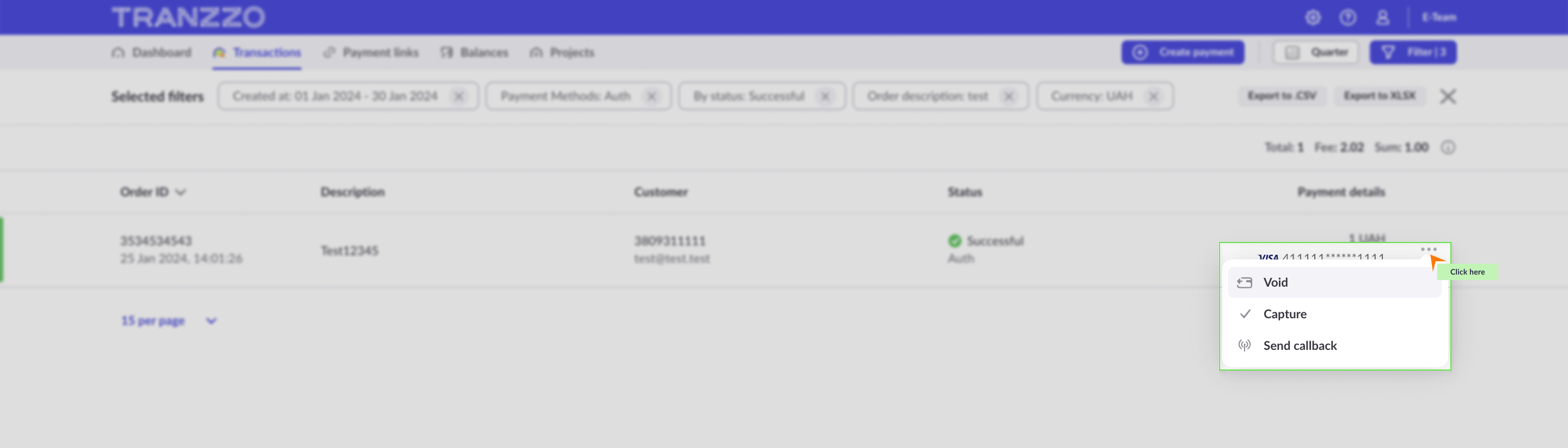

Depending on the transaction method, the following functions are available:

- Void Available for successful Pre-authorization (auth) transactions. When selected, the entire amount previously reserved on the payer's account is released.

- Capture Available for successful Pre-authorization (auth) transactions. Enter the amount to be captured. If only part of the reserve amount is captured, the remaining amount is automatically released.

- Refund (split payment refund) Available for successful purchase or capture transactions. Refunds can be made in full or in part. There are specific considerations when working with the fiscalization of payments.

- Download receipt

Available only for successful purchase, credit or refund transactions.

For auth transactions, a receipt can be downloaded if a capture has been completed - Відправка callback - а щодо платежу на ваш ендпоїнт.

- Send callback initiates sending a callback to your endpoint.

- Download credit reference

Available only for successful credit transactions, provided that the corresponding feature is configured for your project. - Update transaction status to actualize it.

To view the features available for a specific transaction, click on the corresponding transaction component. The set of functions for a transaction depends on its method and status.

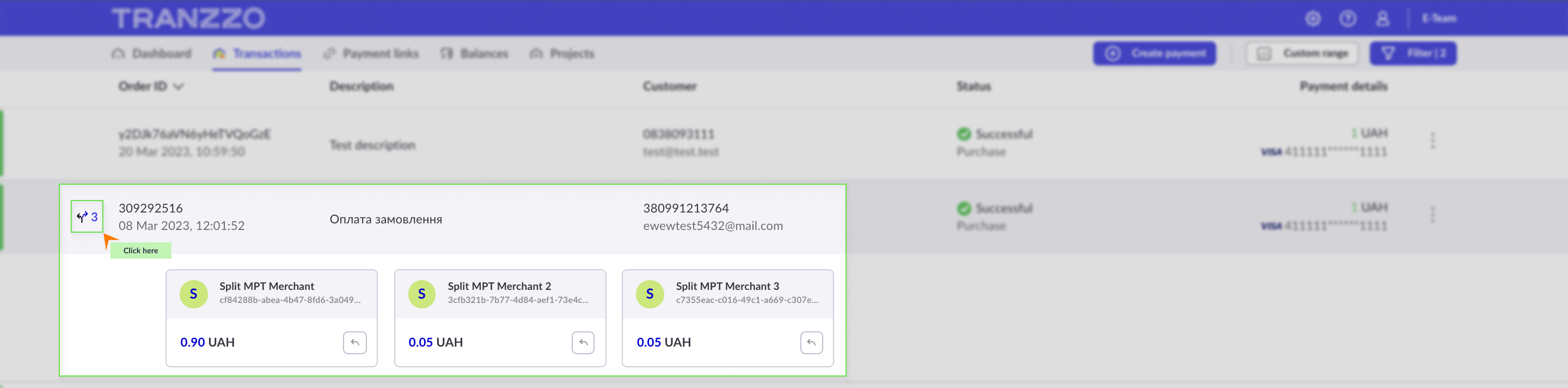

Split payment records also contain information about the included sub-transactions, which can be expanded by clicking on a specific component.

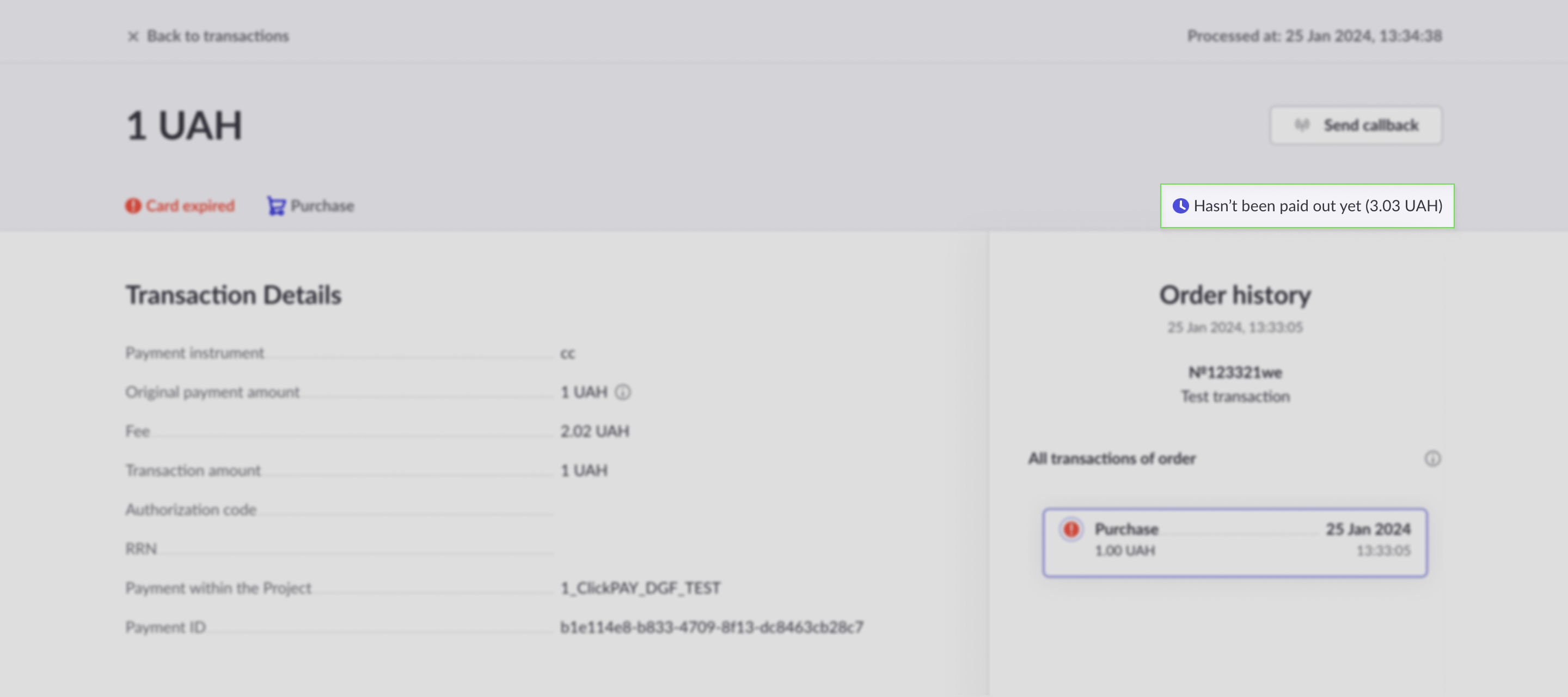

Transaction details

You can view the details of each transaction by simply clicking on it in the transaction list.

For a standard transaction, the window that opens contains the following sections:

- Transaction information:

- Payment method: the payment instrument used.

- Transaction amount: the amount without external commission (if applicable).

- Transaction commission: the fee associated with the transaction.

- The total amount of the transaction including the commission.

- The transaction authorization code from the bank.

- RRN: the transaction identifier in the bank's payment processing system.

- The name of the payment project under which the transaction was carried out.

- The unique identifier of the transaction in our system.

- Payer Information:

- Name

- Phone

- The IP address from which the payment was made.

- Payer card mask

- The brand of the payment card used to make the payment

- Issuing bank

- Recipient's card mask for P2P.

- Order History: a list of all transactions that took place under the relevant order. You can switch between transactions by clicking on the corresponding entry in the list.

- Additional features available for the transaction.

Depending on your business model, the payment details may also indicate whether the payment was credited to your bank account.